Publicly Traded Sports Teams: Investment Opportunities in Professional Athletics

Publically trade sports teams: a rare investment opportunity

Professional sports teams represent some of the virtually valuable and recognizable brands in the world. While most sports franchises remain privately own by wealthy individuals or consortiums, a select few offer public ownership opportunities through stock exchanges. These publically trade sports teams provide fans and investors alike the chance to own a piece of their favorite franchises.

Major American sports teams on public markets

In the United States, the landscape for publically trade sports teams is rather limited compare to other markets around the world. Presently, exclusively one major American sports franchise offer direct public ownership.

Green Bay packers: community ownership model

The Green Bay packers of the national football league (nNFL)represent a unique ownership structure in amAmericanports. While not traditionally “” blically trade ” ” stock exchanges, the packers operate under a community ownership model where fans can purchase shares during occasional stock offerings.

Key points about packers ownership:

- Shares do not increase in value and pay no dividends

- Ownership provide voting rights but limited financial benefits

- Stock sales are infrequent (near lately in 2021 )

- Proceeds typically fund stadium improvements

This structure make packers stock more of a collectible memorabilia item than a traditional investment, though it does provide fans with a sense of ownership in the team.

Madison Square garden sports corp (nNYSE msgs )

Madison Square garden sports corp represent the closest thing to a pure play publically trade sports team in the United States. The company own and operate:

- New York Knicks (nNBA)

- New York rangers (nNHL)

After a corporate split in 2020, msgs straightaway focus mainly on these sports franchises, make it fundamentally a way to invest in these two iconic New York teams. The company’s stock performance is tie to the value of these franchises, their media rights, and associate revenue streams.

Liberty media Formula One group (nNASDAQ fFiona)

While not a traditional team investment, liberty media Formula One group offer investors exposure to the formula 1 racing series. Through this stock, investors gain indirect ownership in:

- Formula 1 racing series

- Associated media rights and sponsorship

- Event revenues from races global

This represents more of an investment in a sports league than individual teams, but provide similar exposure to the economics of professional sports.

European football clubs on public markets

Europe offer importantly more opportunities for invest in publically trade sports teams, especially in football (soccer ) Several prominent clubs have lilistedheir shares on various exchanges.

Manchester United (nNYSE mManu)

One of the world’s almost valuable sports franchises, Manchester United has been publically trade on the New York stock exchange since 2012. As a publically trade entity, Manchester United offer investors:

- Exposure to one of the virtually recognizable global sports brands

- Revenue from broadcasting rights, merchandise, and match day income

- International market exposure through the club’s worldwide fan base

Despite its public listing, the majority ownership remains with the glazer family, give public shareholders limited control over club operations.

Source: finbold.com

Borussia Dortmund (eetc bBVB)

List on the Frankfurt stock exchange, Borussia Dortmund represent one of Germany’s near successful football clubs. The team operate under the Bundesliga’s 50 + 1 rule, which ensure majority club control remain with members quite than external investors.

Invest in Borussia Dortmund provide:

- Exposure to one of Europe’s top football leagues

- Revenue from the club’s player development and transfer model

- Income from domestic and European competition participation

The club’s reputation for develop young talent that can be sold at significant profit make its business model distinct from some other publically trade teams.

Juventus (bit: jJune)

Italy’s virtually successful football club, Juventus, trade on the Borsa Italiana. The Turin base team offer investors:

- Stake in one of Italy’s nearly storied sports franchises

- Revenue from Serie A and European competition

- Exposure to the club’s global brand and merchandising operations

Like many European football clubs, Juventus has experience significant volatility as team performance and player acquisitions can dramatically impact financial results.

Celtic FC (lLon cCCP)

Scotland’s Celtic FC trades on the London Stock Exchange, offer investors access to one of the almost historic clubs in British football. Investment highlights include:

- Steady revenue from loyal supporter base

- Regular participation in European competitions

- Dominant position in Scottish football provide consistent performance

The club’s comparatively smaller market compare to Premier League teams result in different investment dynamics and valuation metrics.

AFC Ajax (aAMS aAjax)

Dutch powerhouse Ajax Amsterdam trade on the Euronext Amsterdam exchange. The club is renowned for:

- Elite youth development system produce valuable players

- Regular Champions League participation

- Strong transfer market profits from player sales

Ajax’s business model of develop and sell players make its financial performance moderately different from clubs that focus mainly on immediate competitive success.

Asian publically trade sports teams

Asian markets besides offer several opportunities to invest in publically trade sports franchises, especially in Japan.

Nippon professional baseball teams

In Japan, several professional baseball teams are subsidiaries of publically trade corporations:

- Han shin tigers( own by Hansen electric railway co. )

-

Your giants ( o( by yomiyourup )

) - Yak ult swallows( own by yak ultHonshua co.)

While these teams themselves aren’t direct list, invest in their parent companies provide some exposure to their operations and performance.

Investment considerations for publically trade sports teams

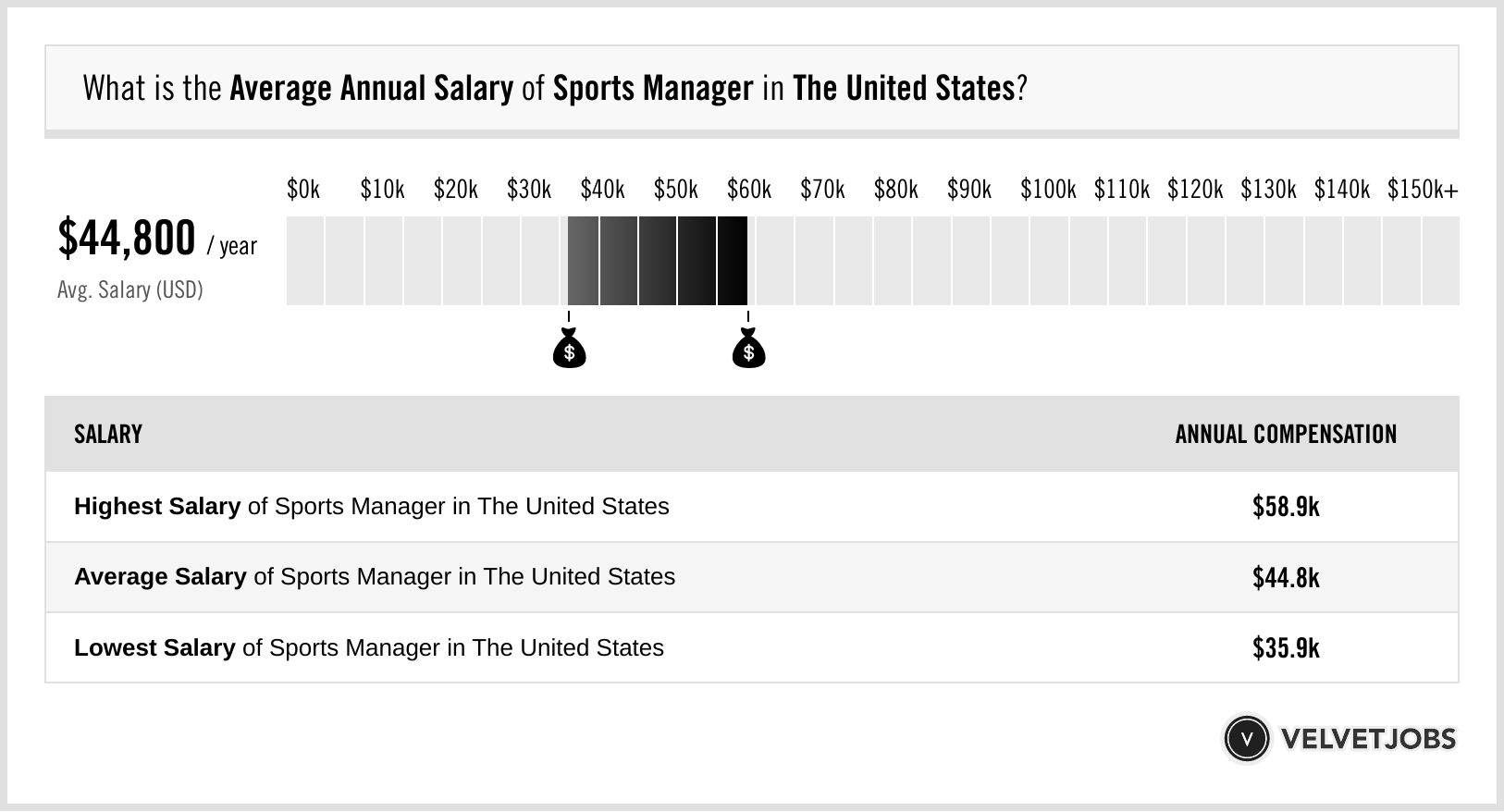

Financial performance vs. Team performance

One of the virtually challenging aspects of invest in sports teams is the sometimes tenuous relationship between on field success and financial performance. Investors should consider:

- Team performance can drive short term stock volatility

- Player acquisitions may be necessary for competitive success but can strain finances

- Revenue stream like broadcasting rights may be more stable than performance base income

They advantageously run sports franchises maintain financial discipline while pursue competitive success, but these goals can sometimes conflict.

Revenue streams and business models

Modern sports franchises derive revenue from multiple sources:

- Media rights and broadcasting deals

- Match day revenue( tickets, concessions, parking)

- Commercial partnerships and sponsorship

- Merchandise sales

- Player transfer fees (especially in eEuropeanfootball )

Different teams emphasize different revenue streams base on their market, league structure, and competitive position.

Regulatory and league considerations

Sports teams operate within complex regulatory environments that can impact investment potential:

- Salary caps and financial fair play rules

- Revenue sharing arrangements within leagues

- Promotion and relegation systems (in eEuropeanfootball )

- League specific ownership restrictions

These factors can importantly impact a team’s financial flexibility and growth potential.

Valuation challenges

Value sports franchises present unique challenges compare to traditional businesses:

- Brand value and prestige may outweigh current financial performance

- Scarcity value of major league franchises

- Emotional attachment and fan loyalty create price premiums

- Media rights inflation potentially drive future value

These factors oftentimes result in sports teams trade at valuations that would seem excessive for businesses in other industries.

Alternative ways to invest in sports

For investors interested in sports exposure beyond the limited number of publically trade teams, several alternatives exist:

Sports relate ETFs

Exchange trade funds focus on sports and entertainment can provide diversified exposure:

- Round hillMVPpETFf( NYSE: MVP)

- Global x video games & esports ETF (nNASDAQ hero )

These funds typically include sports teams alongside media companies, equipment manufacturers, and other related businesses.

Sports betting and gaming companies

The growth legalization of sports betting hacreatedte investment opportunities in companies like:

- DraftKings (nNASDAQ dDeng)

- Flutter entertainment (lLon fFLHR)

- Penn entertainment (nNASDAQ pPenn)

These companies offer exposure to sports economics without direct invest in teams.

Sports media and rights holders

Companies that own broadcasting rights and sports media properties include:

- Walt Disney company (nNYSE dis ) pnESPN

- Comcast (nNASDAQ cFMCSA) c NBCrts

- Fox corporation (nNASDAQ fox ) x Fox Sports

Media rights continue to grow as a percentage of sports industry revenue, make these companies significant players in the sports economy.

Sports apparel and equipment manufacturers

Major sports equipment and apparel brands offer another avenue for sports relate investment:

- Nike (nNYSE nNik)

- Adidas (eetc ads )

- Under armor ((yNYSEuaUAA)

These companies benefit from their associations with teams and athletes while offer more traditional business models for investors to analyze.

The future of public ownership in sports

Several trends may shape the landscape for publically trade sports teams in the come years:

League expansion and new markets

As major sports leagues expand into new markets, opportunities for public ownership structures may emerge:

- MLS expansion in North America

- NFL and NBA international growth

- Emerge market league development

These expansions could create new investment vehicles for sports enthusiasts.

Alternative ownership models

Innovative ownership structures are begun to emerge:

- Fan tokens and blockchain base ownership shares

- Crowdfund minority stakes

- Hybrid public private structures

These models may provide more accessible entry points for smaller investors interested in sports ownership.

Media rights evolution

The ongoing transformation of sports media consumption could impact team valuations:

- Direct to consumer streaming services

- Social media content monetization

- Global audience development

Teams that successfully navigate these changes may see significant value appreciation.

Conclusion

Publically trade sports teams represent a unique investment category that blend financial considerations with the passion and loyalty that sports inspire. While the number of pure play public sports team investments remain limited, specially in North America, opportunities exist globally for investors interested in this sector.

For sports enthusiasts look to combine their passion with investment potential, publically trade teams offer the rare opportunity to become an owner, nonetheless small, of the franchises they support. As with any investment, thorough research into the specific team’s financial structure, revenue streams, and growth prospects remain essential before commit capital.

The emotional connection many fans feel toward their favorite teams can cloud investment judgment, make it especially important to approach these investments with clear financial objectives kinda than strictly sentimental considerations. With the right approach, nonetheless, publically trade sports teams can offer both the financial returns of an investment and the emotional satisfaction of sports team ownership.

Source: online.jwu.edu

MORE FROM lowcostbotox.com