Sports Insurance: Complete Protection for Athletes and Organizations

Understand sports insurance

Sports insurance serve as a financial safety net for athletes, teams, organizations, and event hosts involve in sporting activities. This specialized coverage address the unique risks associate with athletic participation and competition that standard insurance policies typically exclude.

Unlike general liability or health insurance, sports insurance specifically target the high risk nature of physical activities, offer protection against injuries, property damage, cancellations, and liability claims that ofttimes occur in sporting environments.

Types of sports insurance coverage

Athlete injury protection

Athlete injury insurance from the cornerstone of sports coverage. This protection address medical expenses result from injuries sustain during practice, training, or competition. For professional athletes, this coverage extends beyond basic medical costs to include:

- Emergency medical treatment

- Rehabilitation services

- Loss of income during recovery

- Career end injury benefits

- Disability coverage

Many policies offer specialized coverage base on sport specific risks. For instance, football players might receive enhanced coverage for concussions and joint injuries, while gymnasts might have policies focus on spinal and wrist protection.

Liability insurance

Liability coverage protect sports organizations, coaches, and facility owners from legal claims arise from accidents or injuries. This includes:

- General liability for bodily injury to participants or spectators

- Property damage liability

- Professional liability for coaches and trainers

- Directors and officers liability for organizational leadership

When a spectator slip in the stands or a participant claim negligent coaching lead to injury, liability insurance cover legal defense costs and potential settlements, protect the financial stability of sports organizations.

Event cancellation insurance

Sports events represent significant financial investments. Cancellation insurance protects against losses when events must be postponed or cancel due to:

- Adverse weather conditions

- Venue damage

- Participant illness or injury

- Civil unrest

- Transportation failures

This coverage reimbursesnon-refundablee expenses, lose revenue, and additional costs incur from reschedule, provide financial stability when unexpected circumstances arise.

Equipment and property insurance

Sports equipment represent a substantial investment for teams and individuals. Equipment insurance cover:

- Damage to sporting equipment

- Theft protection

- Transit coverage during team travel

- Specialized equipment replacement

For facility owners, property insurance extend to buildings, fields, courts, and permanent fixtures, protect against damage from natural disasters, vandalism, or accidents.

Who need sports insurance?

Professional athletes

Professional athletes require comprehensive coverage to protect their careers and earnings potential. Their insurance typically includes:

- Contract protection guarantee

- Loss of future earnings coverage

- Endorsement income protection

- Specialized medical coverage

High profile athletes frequently secure policies worth millions to safeguard against career threaten injuries. For instance, soccer players often insure their legs, while pitchers in baseball protect their throw arms with specialized coverage.

Amateur athletes and youth sports

Youth sports organizations and amateur athletes need protection that focus on:

- Basic medical coverage for injuries

- Liability protection for coaches and volunteers

- Facility and equipment coverage

- Transportation liability

Parents oft discover that family health insurance contain exclusions for organize sports activities, make supplemental sports coverage essential for children participate in athletic programs.

Sports organizations and leagues

Organizations range from local recreational leagues to national governing bodies require comprehensive insurance programs include:

- Participant accident coverage

- General liability protection

- Directors and officers coverage

- Property and equipment insurance

- Crime and fraud protection

These organizations typically secure blanket policies that extend coverage to all register participants, volunteers, and events under their umbrella.

Event organizers and facility owners

Those host sporting events or own athletic facilities face unique exposure require:

- Premise liability coverage

- Event cancellation protection

- Spectator injury coverage

- Vendor and contractor liability

Facility insurance oft includes business interruption coverage to replace lose income when venues must close for repairs or renovations.

How sports insurance work

Risk assessment and premium calculation

Insurance providers evaluate numerous factors when determine premiums for sports coverage:

- Sport type and inherent risk level

- Number of participants

- Age and skill level of athletes

- Safety protocols and equipment requirements

- Claims history

- Coverage limits and deductibles

High risk sports like football, hockey, and gymnastics typically command higher premiums than lower risk activities such as swimming or tennis. Organizations with strong safety records and risk management programs oftentimes qualify for premium discounts.

Claims process

When injuries or incidents occur, the claims process typically follows these steps:

- Immediate incident documentation and report

- Submission of claim forms with support evidence

- Medical evaluation and treatment documentation

- Insurer review and coverage determination

- Benefit payment or reimbursement

Many sports insurance providers offer specialized claims services with representatives familiar with sport specific injuries and treatment protocols, streamline the claims process.

Coverage limitations and exclusions

Sports insurance policies contain important limitations and exclusions:

- Pre-existing conditions

- Injuries result from prohibit activities

- Intentional acts or violations of rules

- Injuries occur outdoor sanction events or practices

- Certain high risk activities within sports

policyholders must exhaustively review these exclusions to understand potential coverage gaps and secure additional protection when necessary.

Benefits of sports insurance

Financial protection

The primary benefit of sports insurance is financial protection against potentially devastating costs. A single catastrophic sports injury can generate hundreds of thousands in medical expenses, while liability claims may reach into the millions. Insurance transfers this financial risk from individuals and organizations to insurers with the capacity to absorb large losses.

Legal compliance

Many sports govern bodies and facility owners require proof of insurance before allow participation or facility use. Insurance coverage satisfy these requirements and demonstrate responsible risk management. Schools, colleges, and youth sports organizations typically must maintain minimum coverage levels to operate lawfully.

Peace of mind

Athletes can focus on performance instead than potential financial consequences of injuries when decently insure. Likewise, organizations can operate confidently know they’re protected against unforeseen events that might differently threaten their financial stability.

Emerge trends in sports insurance

Concussion and CTE coverage

With increase awareness of traumatic brain injuries in sports, insurers forthwith offer specialized coverage for concussion relate claims. These policies address both immediate treatment and potential long term effects, include coverage for chronic traumatic encephalopathy (cCTE)diagnosis and treatment.

Pandemic and communicable disease protection

Recent global health challenges have prompted the development of communicable disease coverage for sporting events. This protection addresses cancellations, postponements, and additional expenses result from disease outbreaks that impact sporting activities.

Data drive risk assessment

Insurers progressively utilize wearable technology and performance data to assess individual athlete risk profiles. This approach allow for more personalized coverage and potentially lower premiums for athletes demonstrate lower injury risk through biometric and performance data.

How to choose the right sports insurance

Assess your specific risks

Begin by conduct a thorough risk assessment consider:

- Sport specific injury patterns and frequency

- Participant demographics and skill levels

- Facility conditions and maintenance

- Transportation requirements

- Event size and spectator exposure

This assessment helps identify priority coverage areas and appropriate policy limits.

Work with specialized brokers

Sports insurance brokers with industry expertise provide valuable guidance in select appropriate coverage. These specialists understand sport specific risks and can identify potential coverage gaps that generalist agents might miss. They besides maintain relationships with insurers specialize in athletic coverage.

Compare policy features

When evaluate policies, look beyond premiums to compare:

- Coverage limits and sublimity

- Deductible amounts

- Claims process efficiency

- Exclusions and limitations

- Additional services like risk management assistance

The lowest premium oftentimes doesn’t represent the best value when coverage gaps exist.

Consider package policies

Many insurers offer comprehensive sports insurance packages combine multiple coverage types. These bundle policies typically provide broader protection at lower cost than purchase separate policies for each risk category. They, too, simplify administration with a single renewal date and point of contact.

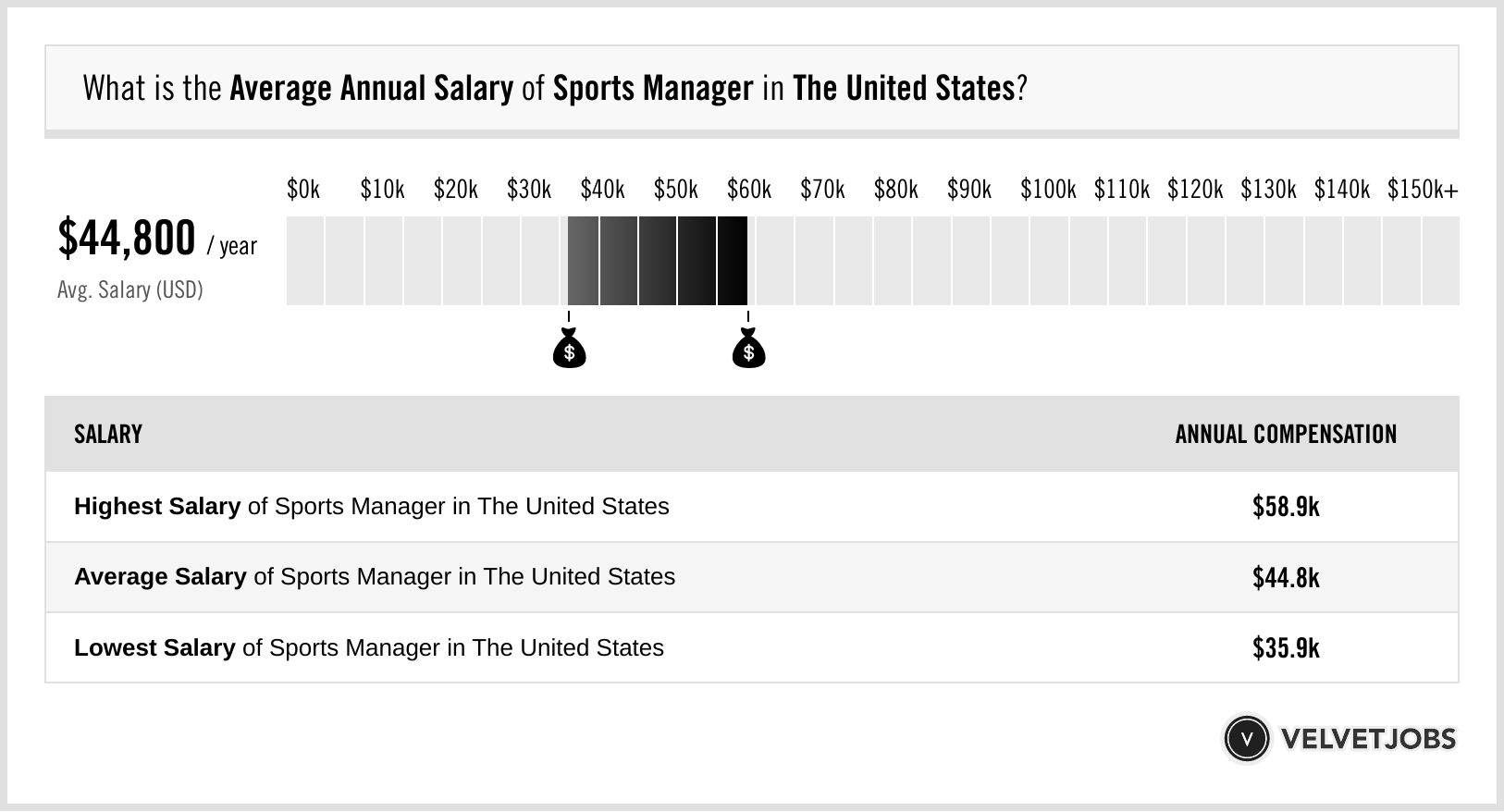

Cost factors and budgeting

Sports insurance costs vary dramatically base on numerous factors. Amateur youth sports organizations might pay $500 $1,500 yearly for basic coverage, while professional teams invest millions in comprehensive protection. Key cost determinants include:

Source: sportsinsurance.com

- Competition level (recreational, amateur, professional )

- Sport type and associate risk

- Coverage limits and deductibles

- Number of participants

- Claims history

- Risk management practices

Organizations should budget 3 7 % of their operational expenses for insurance coverage, with high risk sports require the upper end of this range.

Conclusion

Sports insurance provide essential protection for the unique risks inherent in athletic activities. From professional athletes safeguard multimillion dollar careers to youth leagues ensure participant safety, proper insurance coverage form a critical component of responsible sports management.

As sports continue to evolve with new activities, training methods, and risk awareness, insurance solutions adapt to address emerge challenges. Organizations and individuals involve in sports should regularly review their coverage to ensure it address current risks and provide adequate financial protection.

With proper insurance in place, athletes can focus on performance excellence while organizations deliver valuable sporting opportunities with confidence that they’re financially protect against unforeseen events.

Source: sportsinsurance.com

MORE FROM lowcostbotox.com